Every year as we approach June you will get those KRA emails posted across different social media platforms, even on the conventional media both print such as newspapers and TV Stations to file your taxes before the June tax filing deadline. The Kenyan tax regime is based on self-assessment; every taxpayer is required to file tax returns as per the Tax Procedures Act. This is where a taxpayer declares their income either from employment, business or investment. If a taxpayer only has employment income they are required to declare their tax returns with the guidance of a P9 form.

This article will look more at the P9 form and discuss:

- What is a P9 Form

- Where to get your P9 Form

- How to prepare a P9 form

- Components of a P9 Form

What is a P9 Form ?

A P9 form is a Tax Deduction Certificate issued to employees by an employer. The certificate gives a breakdown of the employee’s salary and the tax that was deducted from their gross pay and paid to KRA on a monthly basis for the months the employee worked.

A P9 is different from a Payslip, which is a statement showing a breakdown of employees’ earnings both basic pay and allowances less deductions that include the tax, NHIF , NSSF and Loans.

Where do I get my P9 Form?

You should get a P9 form from your employer, if you earn a salary above the taxable pay as per KRA PAYE schedule, your employer is required to deduct tax from your gross pay and remit to KRA.

This amount of PAYE deducted from the monthly salary should reflect on your P9, the amount should also tally with the PAYE on your monthly payslips.

For civil servants and government employees, their payslips can be downloaded from the GHRIS Portal -(Government Human Resource Information System) portal. For the Teachers, the P9 form can be downloaded from the TSC Portal

How do I prepare a P9 Form?

If your organization does not have a Human resource system that can generate or prepare the P9 Forms you can make one manually.

To prepare a P9 form you must be acquitted and knowledgeable on the payroll processing process, which is why the P9 form is better prepared by the HR or Payroll Accountants with knowledge on taxes and other statutory deductions such as NHIF, NSSF etc.

You can have a look at our prior article on Employment Tax here or you can take an online short training on employment income from our online learning portal, at the end of that training you will get a Certificate.

Components of a P9 Form

A P9 form contains the following:

- Basic Salary

- Allowances

- Total Gross Pay

- Allowable deductions

- Personal Relief

- Insurance Relief

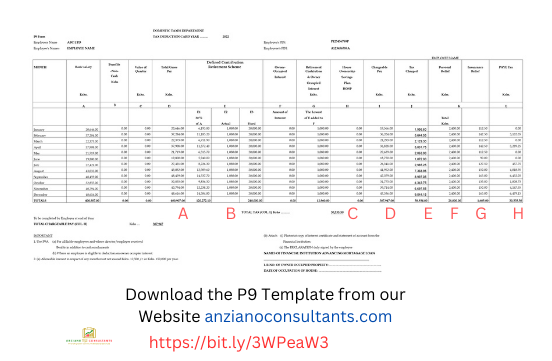

- The P9 form is prepared based on the payroll preparation process where total gross pay inclusive of allowances and non-cash benefits are taxable. (A)

- The allowable deductions (C)) are then subtracted from the total gross pay to arrive at the chargeable pay (D) that is subjected to the existing PAYE tax rates, to arrive at Tax charged. (E)

- The tax charged is then netted off reliefs, (G) i.e. Insurance relief and personal relief currently Ksh 2,400 for only primary and resident employees.

Looking for help getting or preparing a P9 Form?

We have developed an Excel template that is programmed to do everything for you in generating the P9 forms.

The Excel template is developed to factor in all payroll processing procedures and factors in all allowable deductions, it will auto-compute everything for you. All you will require is to type in the names, KRA PINS, and gross pay of your employees. Then it will auto-compute and generate the P9 Forms.

How you can generate P9 Form Online Using our Solution Template

What if I just need to prepare my personal P9 form?

If you are an employee looking for preparation of a P9 form we can do that for you, visit the following page to get the service.

Error: Contact form not found.

In conclusion, the KRA P9 form is an essential document for employees in Kenya, as it not only serves as evidence of gross pay for the year and the amount of tax that was paid to the Kenya Revenue Authority but also helps employees to take advantage of their tax reliefs and deductions.