The government collects revenue through Taxation, and one of the major contributions of this Tax revenue is Employment Income Tax. In Kenya the Kenya Revenue Authority (KRA) collect the Employment tax from Employers who act as Agents. The Employer is required to deduct the Pay as You Earn (PAYE) Tax from employees’ salaries and remit it to KRA. In this article, we will explore more about Payroll Processing and Employment Income Tax in Kenya.

A Brief Overview

- What is PAYE

- Taxpayers Liable to Employment Income Tax PAYE Obligation

- Persons from whom PAYE is collected

- Cash Components of Salary that should be subjected to PAYE

- Non-Cash Remuneration Components that should be subjected to PAYE

- Computation of PAYE

- Allowable Deductions on PAYE

- Payroll Processing

- How to file PAYE Tax Returns

- How to make PAYE Tax Payments

- Penalties for non-compliance

What is PAYE

Taxes are levied on a citizen by laid out laws. In Kenya different Tax Laws dictate which taxes are to be collected. The main one is the Income Tax Act which imposes Tax on income earned from employment.

The income Tax Act imposes Tax on any gains or profits that include; any wages, salary, leave pay, sick pay, payment in lieu of leave, fees, commission, bonus, gratuity, or subsistence, travelling, entertainment or other allowance received in respect of employment or services rendered.

PAYE is a Tax Charged on income gained or earned from Employment to both residents and non-residents which is accrued or derived from Kenya.

Taxpayers Liable to Employment Income Tax PAYE Obligation

Any taxpayer, whether an individual or a body corporate that gives out any form of compensation to any person(s) for employment is liable to register for PAYE Tax Obligation.

Where a person or a company employs people and they are paid a salary that is above Ksh 24,000 per month, they should register with the Kenya Revenue Authority to have PAYE obligation added to their KRA PIN.

Once the PAYE obligation is added to a Taxpayer, he/she is an agent of the Revenue Authority and must deduct the PAYE tax on the employee’s salaries based on the stipulated rates and remit the money to KRA without fail.

Persons from whom PAYE is collected

- Employee

This is a person who is a holder of the private, public or calling office for which remuneration is payable. This also includes an employee who receives pensions from a previous employer.

- Director

This is a person who is appointed by the shareholders to manage the day-to-day affairs of a company. Any allowances and benefits that a director may get are considered part of the basic pay and are subject to PAYE in KENYA,

- Tax Residents

These are people who have a permanent home in Kenya. They are taxed on any income compensation that is accrued in Kenya.

- Non Residents

These are employees who do not have a permanent home in Kenya. However, they are present in Kenya for more than 185 days in that year of income accrued. They are taxable only on their income earned from within Kenya.

Cash Components of Salary that should be subjected to PAYE

- Basic Salary

- Leave Pay

- Payment in Lieu of Leave

- Sick Pay

- Overtime pay

- Payment for working in Hardship Areas

- Club Membership

- Commissions

- Bonuses

Basic Salary

This is the income compensation that is paid to an employee or director for work from the beginning of a month to the end. It is based on the number of days worked. Salary is the minimum amount of income compensation that an employee or director receives under the employment act. It is usually fixed unless there is an increment.

Leave Pay

If an employee works for 12 consecutive months for the same employer, he is entitled to a minimum of 21 working days as annual leave. During this time, the employee is entitled to full pay. Leave pay is the payment given to an employee who does not go on annual leave.

Payment In Lieu Of Leave

This is a payment given to an employee or a director who has terminated his employment contract after working for 12 consecutive months in which he did not go for his annual leave. They are compensated for unused leave days.

Sick Pay

If an employee or a director falls sick and takes some time off from work due to illness, they are entitled to be paid their salaries in full. This pay is subject to PAYE.

Overtime Pay.

Normally the official working hours in Kenya are from 8 am to 5 pm from Monday to Friday. If there is extra work that needs to be done an employee or director may report to work before 8 am or stay behind after 5 pm. The employees are entitled to overtime pay. The pay is subject to PAYE unless the employees are low-income earners whose normal income is taxed at a lower PAYE tax band.

Payment for working in Hardship Areas

In Kenya, some areas are considered hardship areas for compensation purposes. Such areas include areas that do not have good roads and those with insecurity. Employees working in such areas are entitled to hardship allowances. This pay is subject to PAYE in Kenya.

Club Membership

Some employees or directors may be enrolled in various clubs such as health, and golf clubs. If a company pays for the club membership they are considered as components of the basic pay. Club membership is considered a personal expense taxable on the employee. The pay is subject to PAYE.

Commissions

Some companies reward the employees and directors for bringing in extra business such as closing a business deal or generating business under challenging areas or situations. The employee is awarded commissions for bringing in extra work. Companies do this to motivate their employees. These commissions are subject to PAYE.

Bonuses

When companies make a profit in particular years of income, the management may award the employees or directors with bonuses. The bonuses are normally awarded after the closure of the financial year. During that time the company may determine the profits made, profits to award a bonus, profits to distribute as dividends and profits to retain in the company.

Non-Cash Remuneration Components that should be subjected to PAYE

Non-cash benefits that an employee gains from Employment are also subject to PAYE tax. They include things such as:

- Provision of housing by the employer.

- Loans whose interest rates are lower than the prevailing market rate.

- Household utilities such as electricity, water, and telephone expenses in excess of the allowable limit of Ksh 3000 per month.

- Pension contribution paid by an employer to a registered or unregistered scheme in excess of the allowable amount of Ksh 20,000 or Ksh 240,000 per year.

- Pension contribution paid by a tax-exempt employer to an unregistered scheme.

Computation of PAYE

The employment income tax (PAYE) is taxed based on graduated Tax Rates. The total gross pay of employees inclusive of both the cash and non-cash benefits should be subject to the following tax rates. The Finance Act 2023 PAYE brackets:

| KSH (Annually) | Ksh (Monthly) | Tax Rates (%) | |

| First | Ksh 288,000 | KShs 24,000 | 10 |

| Next | Ksh 100,000 | KShs 8,333 | 25 |

| Next | Ksh 5,612,000 | KShs.467,667 | 30 |

| Next | Ksh 3,600,000 | Ksh 300,000 | 32.5% |

| Over | Ksh 9,600,000 | Ksh 800,000 | 35% |

| Personal relief will be Kshs.28,800 per year of the Kshs.2,400 per month |

The current pension tax rates for individuals

| PENSION TAX BANDS | ANNUAL RATES (%) |

| Any amount in excess of tax-free amounts | |

| First KShs.400,000 | 10 |

| Next KShs.400,000 | 15 |

| Next Kshs.400,000 | 20 |

| Next Kshs.400,000 | 25 |

| Any amount over KShs.1,600,000 | 30 |

Affordable Housing Levy

The Finance Act 2023 also introduced an affordable housing levy where each employee is to contribute 1.5% of their Gross Salary to be matched by an equal contribution of 1.5% by their employer.

PAYE for Persons with Disabilities

Persons with disabilities who have met the criteria for tax exemption by KRA are exempted from a certain income threshold. The income that is eligible for a tax exemption is up to Ksh. 150,000 per month or 1.8M annually.

Allowable Deductions on PAYE

These are the amounts deducted from the employees’ or directors’ income compensations to arrive at the amount which will be subjected to tax. They include:

- Mortgage Interest

- Pension Contribution

- Insurance Relief

- Personal Relief

Mortgage Interest

In ascertaining total taxable income under PAYE interest on a loan on money borrowed by a person in respect of a year of income from the first four financial institutions specified in the Fourth Schedule and used to buy or improve a residential house during that year of income is deductible. The interest deduction is up to Ksh 25,000 per month (Ksh 300,0000 per year).

Pension Contribution

An employee who makes a pension contribution to a registered pension fund is entitled to an allowable deduction of up to Ksh 20,000 per month.

Tax Relief

In Kenya, Tax relief is granted on a monthly basis. Basically, they are two types of relief.

Personal Relief

Personal relief is entitled to each employee and in operating PAYE monthly the employer is mandated to allow appropriate relief. When an employee has multiple employers, he is entitled to relief from only one employer. It is currently set at KSH 2,400 per month or Ksh 28,800 per year.

Insurance Relief

Insurance relief is entitled to an employee or director who paid a premium for insurance on his life or the life of his wife or children with a company doing life insurance business in Kenya lawfully and that the sums payable under the insurance are payable in Kenya in the lawful Kenya currency.

It is also applicable to health and education policies for himself, his wife or children. However, the relief is allowable in case the education policy maturity period is at least 10 years.

Insurance relief is allowable at the rate of 15% of the premium paid to a maximum of KSH 60,000 per annum or KSH 5,000 per month

Payroll Processing

This is a process where employers work on compensating their employees by computing all the hours worked, allocating overtime pay, allowances, and bonuses and deducting charges such as taxes (PAYE), Statutory deductions (NHIF, NSSF) to get the net pay which is remitted to the Employees bank Account.

It is an intense process that is often done by HR managers or Payroll accountants who are knowledgeable on the Employment Tax Laws.

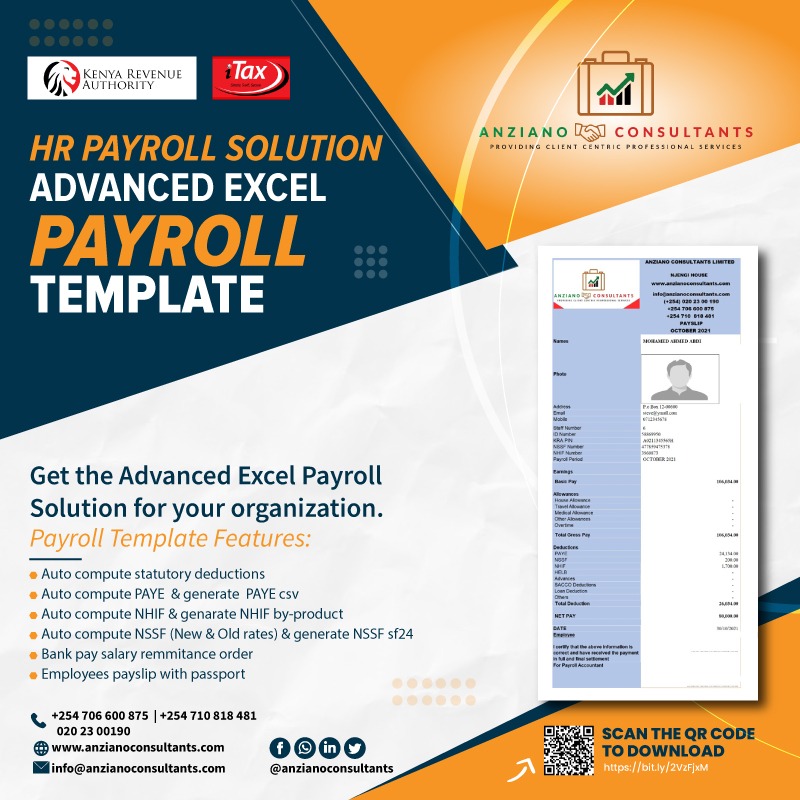

Employers can use various software to manage their Payroll. We have a custom-developed Advanced Excel Payroll Template.

Error: Contact form not found.

Excel Payroll Template

The excel Payroll Template is coded and programmed to auto-compute the taxes and the statutory deductions. It also generates Employees Pay slips among other features;

- Auto-compute statutory deductions such as NHIF, NSSF AND PAYE

- Auto compute PAYE and generate PAYE CSV

- Auto-compute NHIF and generate NHIF by-product

- Auto compute NSSF (New and old rates) and generate NSSF SF24

- Bank pay salary remittances order.

- Employee’s payslip with a passport photo.

Tax Deduction Card (P9 Form )

At the end of the year, the Employer is required to issue Employees with a Tax Deduction Card, showing how much was being paid to the Employee and how much was deducted for PAYE Tax. The Tax Deduction Card (P9 Form) also helps the employee when it comes to filing their personal Individual Tax returns by June of every year. We have developed a P9 Form Template that can help an Employer generate these P9 forms for their Employees

How to file PAYE Tax Returns

As an employer you are only an agent of the government in withholding the Employment Tax, the amount deducted should be remitted to the Revenue Authority.

Filing of PAYE tax is done online from the Kenya Revenue Authority Portal itax System. An employer should declare all employees and amounts deducted from them for PAYE tax deducted on the KRA P10 Excel File provided by KRA.

How to Make PAYE Tax Payments

After filing PAYE tax returns, a payment slip should be generated from the itax Portal under the payments module.

Once a Payment is registered on itax for the PAYE, the Payment can be made at any partner bank with KRA or via KRA Mpesa Paybill for amounts below KSh 70,000.

Penalties for non-compliance

The due date for filing and payment of PAYE tax is by 9th of Every Month.

Late filing of the PAYE tax attracts a Penalty of 25% of the tax due or Ksh 10,000 whichever is higher.

Late payment will attract 5% of the tax due and interest of 1% per month.

If an employee fails to file their annual returns by 30th June of the following year, they attract a penalty of KSh. 20,000

CONCLUSION

The employer needs to maintain proper records of employee details for the purposes of filing PAYE. They have the obligation to file proper PAYE returns and effect payments by the statutory due dates.

In case you are having a problem with filing PAYE you can contact us by mobile at +254706600875 or email us at info@anzianoconsultants.com, we will be happy to serve you.