The internet has reduced the word to a global village, where people can communicate and transact business while miles apart. Business transactions take place through websites and mobile applications. Ecommerce business model has been on the rise where business no longer operates in a fixed location and during a specific timeframe but operate 24/7 and can be accessed globally online. Ecommerce platforms such as Amazon, Alibaba-bay, Jumia, Masoko, Kilimall generate a lot of revenue which is actually generated from different jurisdiction since they sell globally.

The income generated by these platforms and other business that use eCommerce model kind of business has not been netted into the Tax net by most countries. When a local citizen in Kenya subscribes for Netflix, buys products on Amazon or pays Cloud Storage to google, the money s/he pays is not recognised as income in Kenya and is never taxed in Kenya but on another jurisdiction. The Taxman wants a piece of this, the income that has been generated in Kenya has to be taxed, however, a major challenge has been because the business doesn’t have a physical presence in Kenya. The finance Act 2020 introduced a new tax regime that is effective 1st Jan 2021 known as Digital Service Tax.

Key Terms Definition that relates to Digital Service Tax

Digital Market place: means a platform that enables direct interaction between buyers and sellers of goods and services through electronic means.

Digital marketplace provider: means a person who provides a digital marketplace.

Digital Service: means any service that is delivered or provided over a digital marketplace.

Digital Service Provider: means any person who provides services through a digital marketplace.

Platform: means any electronic application that allows digital services to be connected to users of the services, directly or indirectly

Digital Service Tax is a tax payable on any income derived or incurred in Kenya from services offered through a digital market place.

Services that are subject to Digital Service Tax

Any business that is engaged in either of the following services via a digital market place shall be required to file and pay the DST tax:

- Downloadable digital content including downloadable mobile applications, e-books and films

- Over-the-top services including streaming television shows, films, music, podcasts and any form of digital content

- Sale of, licensing of, or any other form of monetising data collected about Kenyan users which has been generated from the users’ activities on a digital marketplace

- Provision of a digital marketplace

- Subscription-based media including news, magazines and journals

- Electronic data management including website hosting, online data warehousing, file-sharing and cloud storage services

- Electronic booking or electronic ticketing services including the online sale of tickets

- Provision of search engine and automated held desk services including the supply of customised search engine services

Services Exempt from the Digital Service Tax Regime

Online services which facilitate payments. Lending or trading of financial instruments, commodities or foreign exchange carried out by:

- Any financial institution

- Any financial service provider authorised or approved by Central Bank of Kenya.

Online services provided by the Government institutions shall also be exempt from the digital service tax e.g payments for services via ecitizen

Digital Service Tax Rate.

The tax rate for the DST tax is 1.5% of the gross transaction value.

What Constitutes the Gross Transaction Value?

The gross transaction value shall be:

- In case of the provision of digital services, the payment received as consideration for the services.

- In case of a digital market place, the commission of the fee paid to the digital market place provider for the use of the platform.

However, the digital service tax shall not include the value-added tax for the service.

To whom does the Digital Service Tax Apply?

The DST tax applies to all Resident and Non-residents who derive income from Kenya through a digital market place.

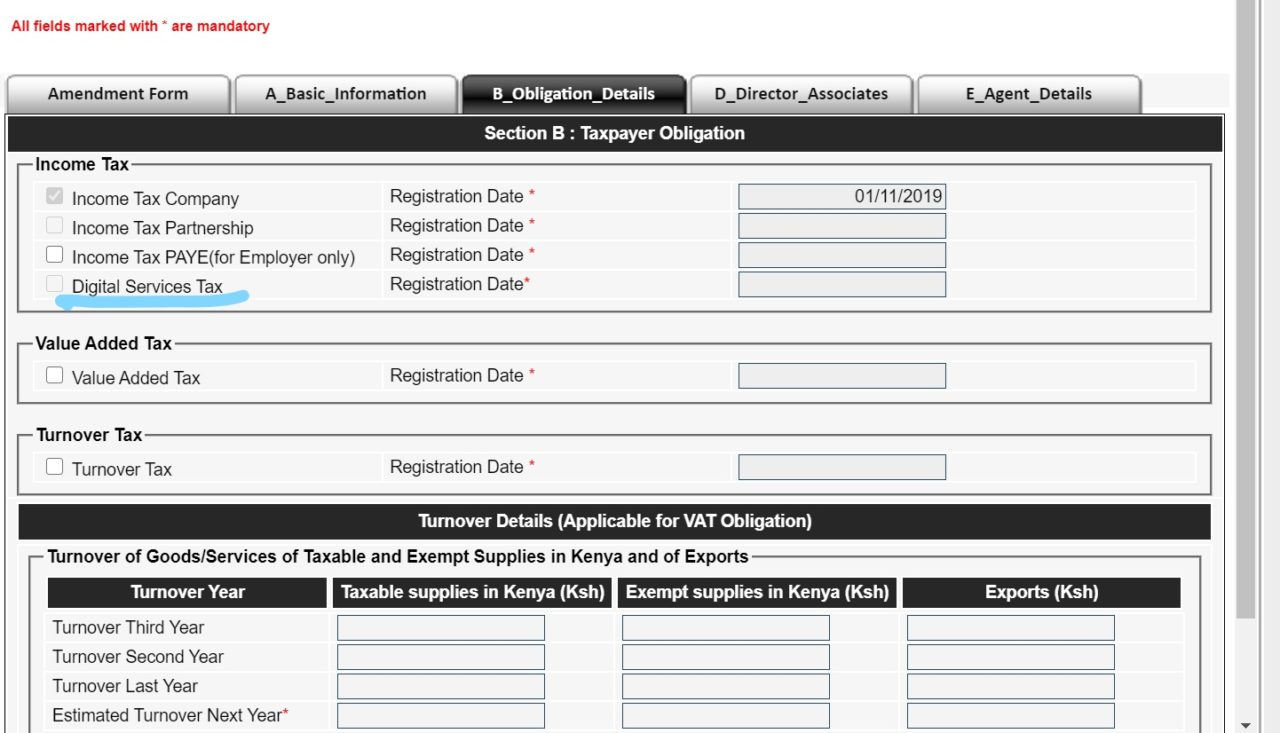

Registration for Digital Service Tax Obligation

A non-resident person without a permanent establishment in Kenya who provides a digital service to a user in Kenya may register under the simplified form on itax for the DST tax obligation, or;

A non-resident person without a permanent establishment in Kenya who opts not to register may appoint a tax representative per section 15A of the Tax Procedures Act 2015.

Therefore, any non-resident person who provides digital services to Kenyans and does not have a physical presence in Kenya and does not want to register for the Digital Service Tax can appoint a tax representative to account for and file the tax. We have authorized tax agents in case you would want to appoint us as your Tax representatives, contact us here

Deregistration for the Digital Service Tax Obligation

A person registered for the DST tax obligation who ceases to provide digital services in Kenya should apply to the Commissioner for deregistration in the prescribed form.

The establishment that a service was provided via a digital market place in Kenya

The digital service shall be deemed to have been located in Kenya if any of the following condition is met:

- The user receives the digital service from a terminal located in Kenya, where the terminal includes a computer, tablet and mobile phone;

- The payment for the digital service is made using a debit or credit facility provided by a financial institution or company located in Kenya;

- The digital service is acquired through an internet protocol address registered in Kenya or an international mobile phone country code assigned to Kenya; or

- The user has a business, residential or billing address in Kenya.

The due date for filing and paying Digital Service Tax

The tax shall be filed and due by the 20th day of the following month following the month that the digital service was offered.

E.g since DST tax is effective 1st Jan 2021, digital service tax should be filled and paid by 20th Feb 2021.

Is Digital Service Tax Final?

Digital service tax paid by a resident or a non-resident person with a permanent establishment in Kenya shall be offset against the tax payable by that person for that year of income. The tax, therefore, serves as an advance tax paid on services provided on the digital market place.

For non-residents persons without a permanent establishment in Kenya, the tax shall be final.

Penalty for Non-Compliance

A person who fails to comply with the provisions of the Digital Service Tax on Registration, filing or payment, shall be liable to the relevant penalties as prescribed under the Tax Procedures Act, 2015.

Wrap Up

The Digital Service Tax seeks to increase government revenue as the government seeks to source more money for the budget. Its is also fair that multinationals that offer services to Kenya’s pay a share of the revenue they earn from Kenyans as tax.

However, there should be a threshold on the minimum amount of gross transaction value that’s is chartable since some of the online transactions are of negligible amounts.