The coronavirus has adversely affected the global economies, the disease which has already been declared a pandemic by the World Health Organization (WHO) has affected how mankind interact and conduct their day to day activities.

In Kenya, the first case was reported on 13th March 2020. Since then there has been various measures put in place by the Kenyan government to curb the disease from spreading. These includes closing of all schools, ban on all public gathering, 7 Pm to 5 Am Curfew and cessation of movement in and out of the Nairobi Metropolis.

There was a public outcry on the measures as some argue they would starve Kenyans as they face the harsh economic times where there are fewer sales for businesses. In response, the president gave several directives to the National Treasury and the Central Bank which as the Two institutions that implement fiscal and monetary measures to steer the Country’s economy in the right direction. This post explores the Tax measures that are supposed to be implemented following the president’s directive.

The Tax Changes effected to cushion Kenyan Taxpayers

- 100% waiver for income below sh 24,000

- Reduction of the higher Tax bracket rate from 30% to 25%

- Reduction of Turnover Tax from 3% to 1 %

- Reduction of VAT Tax from 16% to 14 %

Reduction of Tax on Employment Income

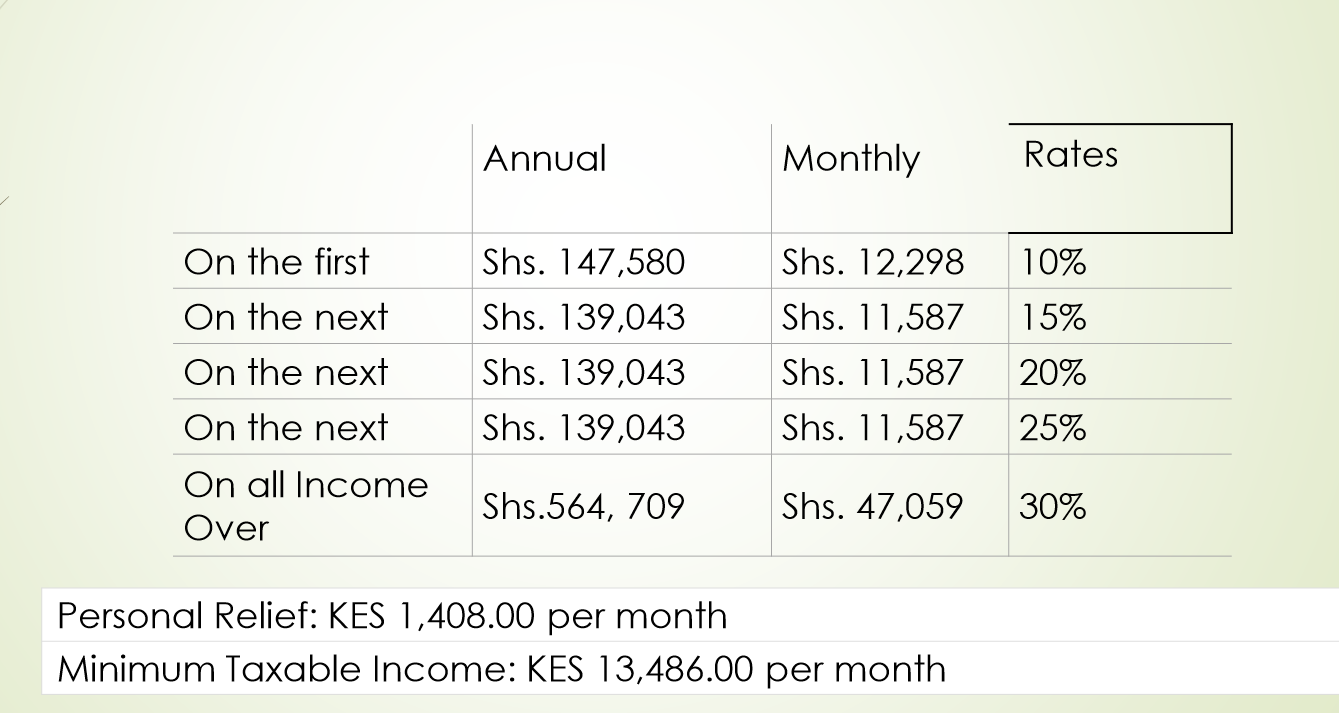

In Kenya, employers are required to deduct employees Pay As You Earn Tax (PAYE) on their salaries and remit to the Kenya Revenue Authority. The PAYE tax is computed using a graduated table where different income brackets are taxed at different tax rates from 10% to 30% for the higher income earners.

| Annual | Monthly | Rates | |

| On the First | Shs.288,000 | Shs. 24,000 | 10% |

| On the Next | Shs. 200,000 | Shs. 16,666.66 | 15% |

| On the Next | Shs. 200,000 | Shs. 16,666.66 | 20% |

| On all Income Above | Shs. 688,000 | Shs. 57,333.33 | 25% |

| Personal Relief: Shs 2,400 per month |

| Minimum Taxable Pay; Shs 24,000 per Month |

Persons earning income below sh 24,000 will now enjoy a 100% waiver on PAYE tax. They will not be deducted the PAYE tax.

On the other hand, the upper Tax bracket for higher-income earners has been reduced from 30% to 25%.

This changes in the Employment income Tax is aimed at ensuring people have more disposable income.

Effective from April 2020 employers should prepare their payrolls in consideration of the Tax changes. We have an updated payroll calculator that can help you compute the amount of PAYE to deduct on an employee’s salary.

Updated PAYE Calculator; calculate PAYE

We have also designed a payroll template that can help employers in preparing payslips and statutory deductions for PAYE, NSSF and NHIF.

Relief for Corporates

The Corporate Tax rate for all Resident Companies has been reduced the Corporate Tax Rate from 30% to 25%.

Resident Limited Companies registered under the Companies Act pay Corporate Tax at 30% of their net profit. The tax is paid in instalment Tax based on an assessment of a company’s previous year’s profit.

For a depth understanding of the corporate Tax, you can contact us for consultancy. We have amazing service packages such as Company Registration Service and Bookkeeping Services that help corporates stay Tax Complaint.

Relief for Small Scale Trader’s

Medium, Small and Micro Enterprises (MSME’s) that were not previously tapped into the Tax net were subjected to Turnover Tax that was reintroduced in 2020. Turnover Tax is a tax charged to MSME’s at a rate of 3% on the gross revenue. Read our elaborate post on Turnover Tax here

The new turnover Tax Rate has been reduced from 3% to 1%. Are you an MSME’s looking for an expert to file your Turnover Tax? Get in touch with us

Value Added Tax (VAT)

VAT tax is a tax that is charged on all supplies made by VAT taxable persons for the supply of goods and services in Kenya. VAT tax has been described as a “complex” tax to understand but we can help you on understand how it operates through our online Training.

The VAT tax rate has been at 16 % but has now been reduced to 14.

Business must adjust their accounting systems to ensure that Invoice and sales recorded effective April capture the reduction of the VAT tax rate.

ETR machine used to generate invoices should also be adjusted to reflect the new 14% VAT tax rate.

Processing of Tax Refunds

Treasury is also expected to pay processed VAT refunds amounting to a tune of 10 Billion. The government has been under pressure by business through institutions such as the Kenya Association of Manufacturers to fast track the VAT refunds and this measure comes as good news for a business that had applied for refunds.

Offsetting VAT Withholding Credits

Kenya Revenue Authority was also directed to allow offsetting VAT withholding credits against other Tax obligations as an alternative to payment of Refund claims.

Withholding VAT tax is a tax that is deducted and paid to KRA at payment point by an appointed withholding Agent.

KRA’S Commitment to Support Taxpayers during the pandemic

KRA has since sent out a message to taxpayers in assurance of its efforts to support businesses. A message that was sent by KRA general Commissioner reads. “As the Country faces this global health challenge, all citizens are called upon to play their part. Therefore, we are encouraging all taxpayers to continue paying all taxes … On its part, KRA will continue supporting individuals and businesses in accessing our services to ensure all taxes are paid in a timely manner at this critical time”

Even as the banks are adjusting their loan repayments, KRA is also asking taxpayers that have a payment plan for amounts they owe to that taxman to be in contact with their debt department where they are unable to honour the plan. If one has a debt with KRA the debt department in an agreement can create a payment plan for the taxpayer to pay the balance in instalments at an agreed period.

Other Measures the government is taking to cushion the Economy:

- Suspension of all listing for all persons including companies at Credit Reference Bureau (CRB)

- Lowering of Central Bank Rate (CBR) to 7.2%

- Lowering of Cash Reserve Ration (CRR) to 4.2%

- Central Bank of Kenya to offer flexibility to banks on loans that were active as of March 2020 to maintain liquidity levels

- Setting up a fund to which players in the Public and Private Sector are contributing in support of Government efforts

Wrap up

The tax amendments is a good move by the government to help save on the economy, however, more needs to be done.

Our team of Tax professionals is on duty to help you with all tax matters. Sanitize, observe social distance and follow the government directives. We Shall Overcome!