The digital space has seen businesses serve customers out of their physical location, this has been a grey area for the tax man who has not been able to assess the online digital economy and collect the relevant tax due to the nature of the transaction where it is done virtually and not in a physical location. In this article, we look at the implementation of the Digital Service Tax in Kenya, to whom the tax applies, and how to register files and pay the digital service tax.

Digital Service Tax (DST) was introduced in the Finance Act 2020 and came into effect in January 2021, DST is a tax charged on income derived or accrued in Kenya from services offered through a digital marketplace.

“Therefore business that provides services to Kenyans through a digital marketplace whether the business is located in Kenya or not are required to pay the digital Service Tax. “

Definition of Terms in Digital Service Tax

The Digital Service Tax Regulations define key terms used as follows:

- “Digital marketplace” has the meaning assigned to it in the section

- “Digital marketplace provider” means a person who provides a digital marketplace platform

- “Digital service” means any service that is delivered or provided over a digital marketplace

- “Digital service provider” means a person who provides digital services through a digital marketplace

- “Platform” means any electronic application that allows digital service providers to be connected to users of the services, directly or indirectly, and includes a website and mobile application.

Services that are subject to Digital Service Tax in Kenya

If your business offers any of the following services to Kenyans, then you are required to pay the Digital Service Tax.

- Downloadable digital content including downloadable mobile applications, e-books and films;

- Over-the-top services including streaming television shows, films, music, podcasts and any form of digital content;

- Sale of, licensing of, or any other form of monetizing data collected about Kenyan users which have been generated from the user’s activities on a digital marketplace;

- Provision of a digital marketplace;

- Subscription-based media including news, magazines and journals;

- Electronic data management including website hosting, online data warehousing, file-sharing and cloud storage services;

- Electronic booking or electronic ticketing services including the online sale of tickets;

- Provision of search engine and automated held desk services including supply of customized search engine services;

- Online distance training through pre-recorded media or eLearning including online courses and training;

- Any other service is provided through a digital marketplace

Digital Service Tax is Exempt for the following Services

- Online services which facilitate payments, lending or trading of financial instruments, commodities or foreign exchange are carried out by— (a)A financial institution and (b) A financial service provider authorized or approved by the Central Bank of Kenya

- Online services that Government institutions provide.

- Income that is subject to withholding tax in Kenya

- Income of a non-resident person who carries on the business of transmitting messages by cable or radio communication, optical fibre, television broadcasting, Very Small Aperture Terminal (VSAT), internet, or any other similar communication.

DST will apply to both residents and non-residents who fall into either of the categories below:

• Digital marketplace providers –A person who provides a platform that enables the direct interaction between buyers and sellers of goods and services through electronic means.

• Digital service providers – A person who provides digital services through a digital marketplace.

Determination if a recipient of Digital Service is in Kenya

Digital Service Tax will be paid by a business if they provide or facilitate the provision of services to a user who is deemed to be located in Kenya.

A user is considered to be located in Kenya if one of the following parameters are met:

- The user accesses the digital interface from a terminal, for instance, a computer, tablet, or mobile phone, located in Kenya;

- Payment for digital services is made using a credit or debit facility provided by any financial institution or company located in Kenya;

- Digital services are acquired using an internet protocol address registered in Kenya or an international mobile phone country code assigned to Kenya; or

- The user has a business, residential, or billing address in Kenya

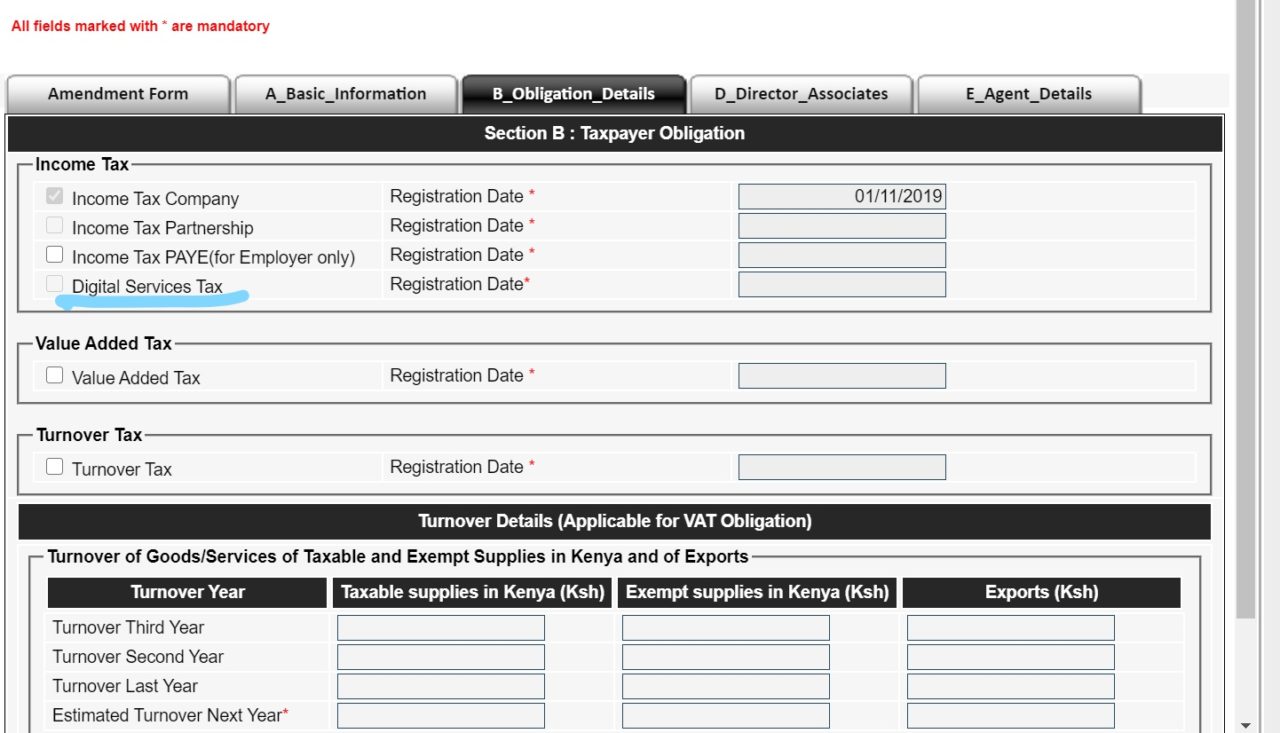

Registration for Digital Service Tax Obligation

Any business that is subject to Digital Service Tax is required to register for the DST obligation, whether the business is a resident or a non-resident.

A resident person or a non-resident person with a permanent establishment in Kenya, who provides a digital service in Kenya shall be required to apply to the Commissioner for digital service tax registration on the itax portal. We can help in this registration

For taxation Services, a resident person is;

- Individual

- An individual with a Permanent home in Kenya.

- An individual without a permeant home in Kenya, but was in Kenya for 183 days or more in an income year under review.

- An individual without a permanent home in Kenya but has been in the country for an average of 122 days in the year of income under review and two other preceding years.

- Non-individuals (Company)

A company is deemed to be a resident in Kenya where:

- The company is registered under Kenyan Laws,

- The Cabinet Secretary for National Treasury and Planning declares the company as registered in the country,

- The management and control of the company are domiciled in the Country.

Permanent Establishment (PE)

A non-resident with a fixed place of business in Kenya which has existed for a period of 6 Months or more or as determined under the Double Tax Agreement.

A non-resident person without a permanent establishment in Kenya who elects not to register in accordance with the regulation set should appoint a tax representative in accordance with section 15A of the Tax Procedures Act, 2015.

Digital Service Tax Rate in Kenya

The tax rate for Digital Service Tax is based on the Gross Transaction Value (GTV).

The Gross Transaction Value shall be;

a) In the case of a digital service provider, the payment received as consideration for the services; and

b) in the case of a digital marketplace provider, the commission or fee paid for the use of the platform

Digital Service Tax shall be computed at a rate of 1.5% of the Gross Transaction Value. The Gross Transaction Value shall not include Value Added Tax.

Accounting for Digital Service Tax

Payment of digital service tax shall be the liability of the digital service provider or any person that collects the payments for digital services.

A digital service provider or their tax representative shall be required to submit a return in the prescribed form indicating the value of transactions and the tax remitted. A person liable for digital service tax is also required to keep records per the Tax Procedures Act,2015.

Is Digital Service Tax Final?

DST paid by a resident or non-resident, with a permanent establishment in Kenya, will be offset against their income tax liability for the applicable year of income.

On the other hand, DST paid by a non-resident without a permanent establishment in Kenya will be the final tax.

Due Date for filing Digital Service Tax

Digital service tax should be filed and paid by the 20th of the preceding month after collection to Kenya Revenue Authority.

After filing the tax by the taxpayer or the tax representative, the tax can be paid at any of the partner banks with KRA or via Mobile money Mpesa.

Conclusion

The introduction of Digital Service Tax in Kenya in January 2021 means that any business offering services on a digital marketplace to Kenyans whether the business is located in Kenya or not have to pay the tax to Kenya Revenue Authority.

Businesses operating online, therefore have to consider registering for this tax obligation if they offer any of the services subject to this regime.

Where a business is a foreign company and does not have a permanent establishment b Kenya, it should appoint a tax agent to be filing and pay the tax. We have authorized KRA Tax agents that can assist in this, click here to contact us for the service

Businesses have to comply with digital service tax to avoid the penalties that are set by the Tax Procedure Act.